Car accident settlements can be difficult to understand. The process can often plague many car accident victims and introduce more confusion and frustration.

So, in simple terms, how does a car accident settlement work? The standard process typically looks like this:

First, an evaluation of “liability” occurs to determine who was at fault for the crash. Second, an evaluation of “damages” occurs to determine the extent of the harms and losses suffered in the crash. If someone is unrepresented, the insurance company will do all of this themselves; however, a good attorney will conduct their own evaluation and provide it to the insurance company along with their own recommendation for how much the insurance company should offer to settle the claims.

Next, if the other driver’s insurance company determines they were at fault and that you were harmed, they will make a settlement offer. At which point you can accept their offer, reject their offer, or make your own counteroffer. Rarely do insurance companies negotiate in good faith. Their goal is not to provide you full and fair compensation but to get you to accept as little as possible to settle your claims. This is when a good attorney makes all of the difference because instead of having to accept the insurance company’s offers, we can file lawsuits and force the insurance company to pay through a jury trial. Although it’s possible for anyone to file a lawsuit and conduct a jury trial on their own, there are so many ways to mess up your claim in litigation that it would be remarkable for an individual to do this on their own successfully.

If you’re interested in learning the car accident negotiation process, continue reading, and we can help clarify how it works.

Need a car accident lawyer in Kansas City? We are the experts you’re looking for. Call us at 816-825-5704 for a free consultation. With us, you’ll never pay us unless we help you win.

How is a Car Accident Settlement Determined?

I always tell people there are two processes to how a car accident settlement is determined. The first is the insurance process. We assist the insurance company in evaluating liability and your damages so they can make a fair offer to settle your claims. For example, they will look at the medical bills you incurred, the injuries you sustained, any lost wages, etc. We make sure the insurance company has fully considered the facts to know the degree to which their insured is responsible for the crash, and we put together all of the potential damages you suffered to make sure they are considered by the insurance company. However, even after providing an insurance company with all of the information necessary, there are many times where they still try to avoid providing full and fair compensation, which is where the second process starts.

Insurance companies do not fully compensate people for their injuries because it is the right thing to do. They do so only when they have to. And the only time an insurance company has to pay is after you have obtained a verdict in your favor against their insured. So it is essential that if you aren’t going to accept the insurance companies’ offer that you be prepared to go the distance to force them to provide you full and fair compensation through a jury trial. Although most cases settle prior to trial, preparing and handling every case as if it were going to trial makes all the difference when it comes to the amount the insurance company knows it will have to pay to settle the claims.

How Insurance Companies Determine Settlements

Insurance companies have developed a playbook over the past several decades to determine how they evaluate claims and try to ensure they pay out as little money on claims as possible. In general, their strategy can be summed up as delay, deny, and defend.

Insurance companies will delay the resolution of a claim for several reasons. First, because they have invested premiums, the longer they hold onto the money, the longer they can earn interest on it. Second, because they have time to play the long game. Insurance companies know that most individuals who have been hurt in an accident are going to need money in the near future; if they can outwait you and catch you at a point when you are desperate for money, they know you are more likely to accept their low ball settlement offer.

Insurance companies will also take every chance they can to deny aspects of your claim. The insurance company will deny their insured was responsible for the crash, even when the facts clearly demonstrate they were at fault. The insurance company will especially take this position if they can convince their insured they weren’t at fault, almost always requiring a lawsuit to be filed. The insurance companies will also deny the extent of the harm you suffered using every trick in the book.

Lastly, the insurance company will defend the claim you bring in court even if they know you are entitled to the compensation you seek. Insurance companies do not hire attorneys that will provide a full and fair evaluation of the claim and ensure the insurance company pays it to protect the insured/client. Insurance companies hire attorneys that will act as an extension of the insurance company, doing everything they can to use the litigation process to devalue the claim, drag out the settlement, or get the injured party to settle for less than full and fair compensation. This can be a frustrating process when a car accident victim(s) is/are trying to get a fair settlement on their losses. Insurance companies are not your friend!

How Lawyers Help Determine Settlements

Lawyers help determine settlements in a variety of ways. First, we try to make it as clear as possible that the other party was at fault in your crash and try to demonstrate the extent of the harm and losses you suffered. This can be through photographic evidence, the police report, witness statements, medical records, lost wage information, etc. Occasionally the insurance company will fully and fairly evaluate the information we provide to them and do the right thing by providing full and fair compensation.

Second, we provide our clients with the ability to go past the insurance settlement process and seek legal redress through the court system for the harms and losses they suffered.

Car Accident Settlement Calculator (FREE)

Try our free car accident settlement calculator to see what your case could be worth. We want you to receive your fair share of compensation for the accident you were in.

How Are Car Accident Settlements Divided?

Each person that is injured in a car accident has their own “claim” for damages. Sometimes these claims are against a single individual, and other times they are against multiple individuals or even a company. When there is limited insurance coverage available, it can be difficult to determine how the available insurance proceeds are to be divided amongst the claimants. This can become another aspect of the negotiation process. In these circumstances, it is important to pursue your claim timely so that your damages can be evaluated before their available insurance proceeds are paid to another claimant.

How Much Is A Typical Car Accident Settlement Worth?

Car accident settlement values vary greatly based on how severe an injury is, who was at fault, and how many parties are seeking compensation. Car accident settlements typically range from $10,000.00 to $100,000.000.

Car accident injury settlements can absolutely be higher than that under certain circumstances. For instance, if an accident involves severe injury or death, settlement values can be up to a million dollars or more.

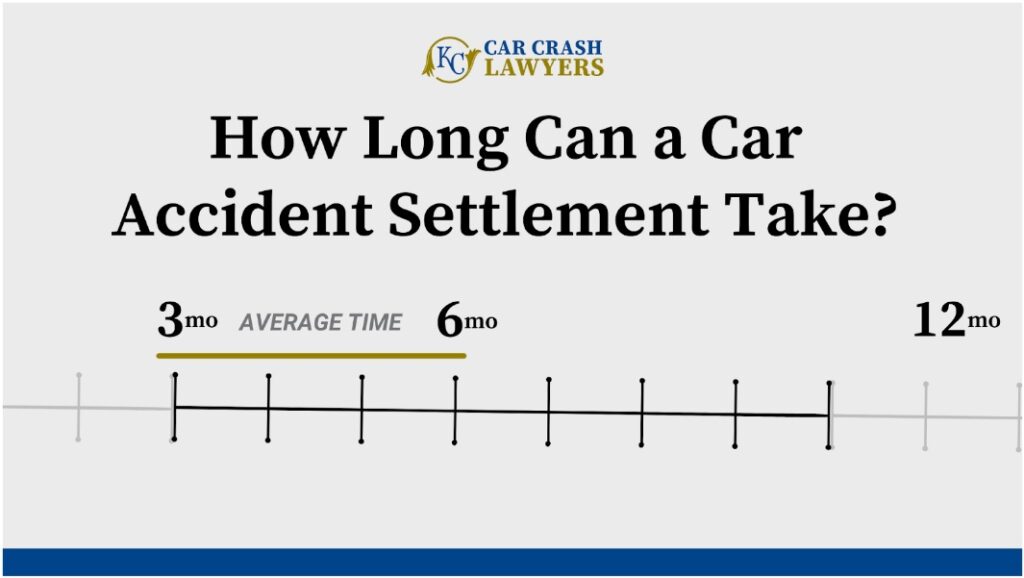

How Long Can a Car Accident Settlement Take?

The average time it takes to complete a car accident settlement is about three to six months after the injured party has completed medical treatment. However, some car accident cases can take up to a year. This is also only true if we do not have to file a lawsuit.

The reason why it can take this long is that all of your medical records and bills have to be collected, analyzed, and submitted to the insurance company once you complete medical treatment. The insurance company then needs to conduct their own evaluation before the claim can be negotiated.

Trusted Car Crash Lawyers in Kansas City, MO

We are experienced car accident lawyers. If you, a friend, or a family member is in an accident and needs legal help, call us at 816-825-5704 for a free consultation.

Our team has handled thousands of cases with success to the benefit of our clients. Give us a call today!